LAST UPDATED ON July 2, 2024

Lifelock vs. Experian Compared: Which Is the Best in 2024?

Last year 42 million American adults fell victim to identity theft which cost $52 billion in total losses. More then half of identity theft cases are unresolved.

Unlike other scams and crimes, identity theft is usually silent.

In many cases, people don’t know that their identity has been stolen until their credit cards are maxed out, their IRS tax refund vanishes or a loan application is denied.

Hands down, the most effective way to protect yourself from identity theft and financial fraud is to sign up to a reputable identity theft protection company.

There are many ID theft protection services in the market, but two of the most popular ones are LifeLock and Experian (IdentityWorks).

Spoiler alert: After thorough testing we found Aura beats both Lifelock and Experian.

In this piece, we’ll look at the features, pros and cons of these two identity theft protection services. At the end, you’ll know enough about these solutions to choose the one that is best for you.

If you’re impatient and just want to read the final verdict of our testing and comparison of the two solution, here is the Final Verdict:

LifeLock and Experian are both solid identity theft protection tools. But neither of them fully protects you from fraud and identity theft.

LifeLock is great for people who want a hands-off approach to identity and credit monitoring. But you’ll have to pay extra to get some necessary security features. Experian, on the other hand, is an affordable option for people who don’t want to spend too much on an ID theft protection tool. But it lacks some security features that keep your data well protected.

Aura beats both Lifelock and Experian – If you’re looking for an all-around identity protection for yourself and your family which have all the features Lifelock or Experian does, you can check out Aura (we’ll talk about Aura later in the article).

LifeLock vs. Experian at a glance

At a glance, here’s how LifeLock and Experian (IdentityWorks) stack up against one another. The main differences lie in specific use case for each, the pricing, ease of use, and available features.

Lifelock is an older company and is tailored for individuals looking for dark web monitoring, alerts to credit card fraud, credit card monitoring, and some other additional features.

Experian is one of the three main credit bureaus and is tailored for individuals looking for tracking their credit scores, credit monitoring, credit freezes, credit locks, credit reports, FICO score simulation and some lightweight dark web monitoring.

Aura which starts at $12/mo beats both Lifelock and Experian because it is an all in one inclusive solution which has all the features of both Lifelock and Experian and is tailored towards all types of individuals as well as families and children.

Take a look at feature comparison of Lifelock vs. Experian below and keep in mind that Aura has all of these and the pricing starts at $12/mo.

| Aura | Lifelock | Experian | |

|---|---|---|---|

| Pricing | $12-$37/mo | $9-$47/mo | $10-$20/mo |

| Free Trial | 14 days | No | 30 days |

| Dark Web Monitoring | Yes | Yes | Yes |

| Identity Monitoring | Yes | Yes | Yes |

| Credit Monitoring | Yes | Yes | Yes |

| FICO Score | 3-bureau credit score | 1-bureau credit score | 1-bureau credit score |

| Password manager | Yes | No | Yes |

| Antivirus & VPN | Yes | As an add on for extra $ | Yes |

| Family plans | Yes | Yes | No |

| Parental Controls | Yes | No | No |

| Credit Lock | Yes | Yes | No |

| Identity Theft Protection | Yes | Yes | Yes |

| Lost Wallet Remediation | Yes | Yes | Yes |

| Ease of use | Easy | Hard | Medium |

| 24/7 customer support | Yes | Yes | No |

| Money Back Gurantee | 60 days | 60 days | No |

| Try Aura For Free |

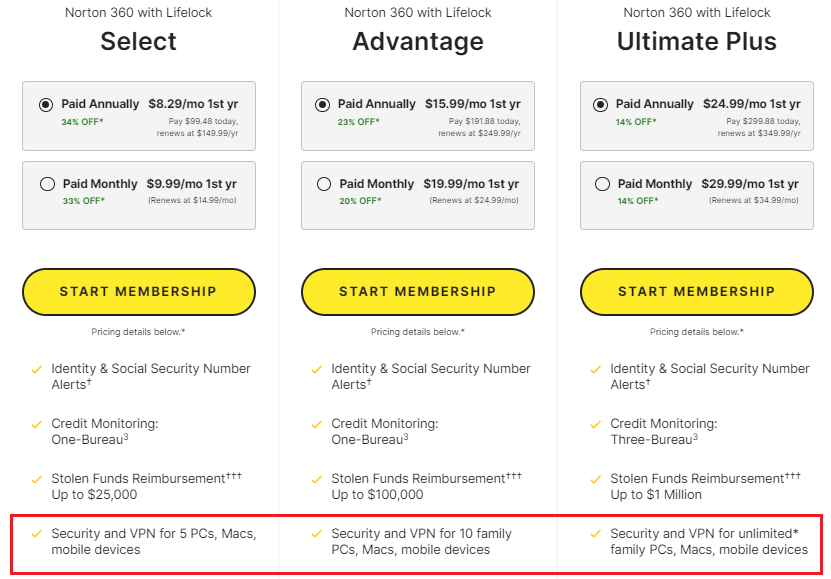

LifeLock Pros, Cons, Pricing

LifeLock is one of the oldest identity theft protection services in the market. It has been around since 2005 and has nearly 50 million customers.

LifeLock offers the following services to protect against identity theft and financial fraud:

- Up to $1 million identity theft insurance (for experts and lawyers only)

- Credit monitoring for 1-3 bureaus

- ID verification monitoring

- Dark Web monitoring

- Sex offender registry monitoring

- Payday loan monitoring

- Identity theft and financial fraud alerts

- Alerts for crimes committed in your name

- Alerts for 401(k) and investment activity

- Annual credit reports and scores from all three bureaus

In 2017, popular security company, Norton, acquired LifeLock. So, along with the above features, you can buy as add-ons antivirus software and VPN to protect your devices from spyware, malware, phishing attacks, and more.

Pros of LifeLock

- Lifelock is a household name with a long history

- LifeLock scans trillions of data points every day to find leaked data

- Integrates well with Norton and its services

- 24/7 customer service

- 60-day money-back guarantee on annual plans

Cons of LifeLock

- While its plans look cheap in the beginning, there’s a significant price increase (over 40%) after the first year. This makes LifeLock more expensive than Aura and Experian

- Customer service reviews for LifeLock and Norton are mostly negative

- The lowest-priced tier is basic and does not offer financial account monitoring

- Deceptive marketing claims. In 2010, the Federal Trade Commission (FTC) sued LifeLock for using “false claims to promote its identity theft protection services”. Jon Leibowitz, FTC Chairman, stated that LifeLock’s data protection actually “left enough holes that you could drive a truck through it.”

- Poor user data protection. In 2015, LifeLock paid $100 million in fines after the FTC sued them for not securing user data. And in 2018, LifeLock had a bug that exposed millions of customer email addresses to the public.

- Publicity stunts. LifeLock promoted their identity theft protection services by displaying their CEO, Todd Davis’, Social Security number on the side of a truck. In fact, Davis himself announced his SSN in ads and TV commercials, which caused hackers to steal his identity 13 times despite LifeLock’s protection.

Pricing: 30-day free trial. Paid plans start at $8.99/month (LifeLock Standard plan), $17.99/month (LifeLock Advantage plan), and $23.99/month (LifeLock Ultimate Plus plan) billed monthly. Prices significantly increase after the first year.

Experian (IdentityWorks) Pros, Cons, Pricing

Experian is widely known as one of the three major credit bureaus, but they offer identity theft and credit monitoring through IdentityWorks.

Experian scans over 600,000 web pages and monitors your credit report across all three bureaus (Experian, Equifax, and TransUnion) to detect any fraudulent activity. IdentityWorks sends you alerts on new credit applications, so you’ll know if someone else applied for a new line of credit with your information.

As a credit bureau, Experian offers FICO score reporting, which is great because FICO is the most widely used type of credit score. It also provides Experian Boost™, a service that can help you improve your FICO score.

Source: Experian.com

Experian also has the CreditLock feature that allows you to lock your credit file if you notice unauthorized activity on your report.

Through IdentityWorks, Experian offers the following services:

- Dark Web surveillance

- Lost wallet assistance

- Social network monitoring

- Identity validation alerts

- Court records monitoring

- Payday loan monitoring

- Financial account monitoring

- Lock and unlock your Experian credit file

- FICO Score Simulator

If you do fall victim to fraudsters, Experian has a dedicated fraud resolution team that can help you get back your identity and lost assets. Experian also offers up to $1 million in identity theft insurance to help you get back on your feet after your identity has been stolen.

Pros of Experian

- Experian’s family plan protects up to 10 children

- Up to $1 million theft insurance coverage

- Real-time alerts on credit applications

- Experian monitors credit across all three bureaus (for the Premium pricing tier)

- 30-day free trial

Cons of Experian

- Customer service is not available 24/7

- The lowest-priced tier does not cover financial account monitoring

- The basic plan provides limited identity protection

- Three-bureau credit reports are only available quarterly (but Experian scored update daily)

Pricing: 30-day free trial. Paid plans start at $9.99/mo (IdentityWorks Plus plan) and $19.99/mo (IdentityWorks Premium plan) for one adult.

LifeLock vs. Experian compared

Now that we’ve discussed the pros and cons of these three tools, let’s see how LifeLock and Experian stack up against each other.

Credit monitoring

A good identity theft protection service will review your credit report and notify you when it detects suspicious activities. These activities include credit inquiries you didn’t make, new accounts you didn’t apply for, and more.

When you get a notification like this, you can lock or freeze your credit report to prevent anyone, including yourself, from requesting a new line of credit.

Both LifeLock and Experian offer credit monitoring services on all price plans, but only at one credit bureau. You’ll need to upgrade to their highest plan to get three-bureau credit monitoring.

At the lower price points, both LifeLock and Experian offer annual credit reports and scores. But with higher plans, you can get your report and score as often as every day.

| Aura, on the other hand, offers credit monitoring across all three major credit bureaus—Equifax, Experian, and TransUnion.

With Aura, you can receive a monthly VantageScore credit score report. You can also get annual credit reports and near real-time alerts of inquiries into your credit files from the three major bureaus. |

Identity theft monitoring

Identity monitoring involves tracking your private information, such as your name, address, phone number, username, passwords, Social Security number, passport number, and health insurance data, to ensure that it hasn’t been leaked online or on the Dark Web. If the tool detects that your information has been leaked, it will alert you to it so you can act quickly.

Both LifeLock and Experian offer identity monitoring. LifeLock sends you a notification if it finds any of your sensitive information on the Dark Web or if there’s been a data breach, which gives you time to change your passwords or security questions. The LifeLock Ultimate Plus and IdentityWorks Premium plans also offer social media monitoring.

With Experian, you can run a dark web scan at any time through the dashboard.

| You can also run a free dark web scan with Aura. |

Financial account monitoring

With financial monitoring, digital security tools can track your bank account details, credit cards, investments, and retirement savings. You can even track your stolen wallets or purses. When the tool detects any fraudulent activity with your finances, it will notify you.

If you’re on the Advantage or Ultimate Plus plans, LifeLock will monitor your finances and notify you about any suspicious activity.

With the IdentityWorks Premium plan, Experian will monitor your bank accounts and credit cards. It will notify you of any potentially fraudulent transactions used by fraudsters, such as payday loans, wire transfers, and tax refunds.

| Aura tracks transactions on your credit cards, bank, and investment accounts on all its plans. It’ll send you alerts if someone gets access to your accounts or tries to create new bank accounts with your personal information. |

Criminal record monitoring

It’s not uncommon for criminals to give false names and information when they’re arrested. This causes innocent people to have arrest records without even knowing it.

That’s why criminal record monitoring is important. It involves monitoring state and national databases of arrests, court records, and sex offender lists.

With the Advantage and Ultimate Plus plans, LifeLock monitors and sends you alerts on crimes committed in your name.

Experian offers criminal record monitoring on the IdentityWorks Premium plan. It scours through court records and sex offender registries to find out if a criminal gave your information to the authorities.

| Aura too, offers criminal and court records monitoring. It notifies you if it detects that a criminal has stolen and used your identity. |

Online and device security

When you use the public Wi-Fi at a coffee shop, restaurant, or public library, it’s easy for a thief to hack the network and steal your data. A great way to protect your device and information is to use a Virtual Private Network (VPN) to muddle up your data and an antivirus to block malware.

If you upgrade your LifeLock plan to include Norton 360 Select plan, you’ll get a VPN and antivirus you can use on 5 (up to unlimited) devices.

Experian does not provide VPN at all.

| On all Aura plans, you’d get a VPN, antivirus, and even a password manager to protect your online data and devices without having to pay extra money. |

Identity restoration

Sometimes, identity thieves steal people’s identities before they’re able to take preventive measures, like freezing their credit or reporting to law enforcement. In this case, the way forward is to try and recover their identities.

If you’re a victim of identity theft, LifeLock and Experian will assign a U.S.-based fraud resolution expert to help you restore your identity and recover lost assets, if any. They can also recommend lawyers who can help you further.

These services also offer lost wallet remediation, which tracks your credit and debit card numbers, driver’s license number, and other ID cards you might have in your wallet or purse. If you lose your wallet, both LifeLock and Experian can get you the information about the IDs in your wallet, so you can start canceling them.

| Aura also offers lost wallet remediation and assigns White Glove fraud specialists if you become a victim of identity theft. |

Identity theft insurance

Bouncing back from a stolen identity can be expensive—and that’s not including the huge amounts of money fraudsters might steal while they still have your identity. Many identity theft protection tools offer some money to help you pay for recovery and get back on your feet.

LifeLock offers $1 million for experts and lawyers on all plans. But for stolen funds reimbursement, LifeLock only provides $1 million on the Ultimate Plus plan. The Standard and Advantage plan includes up to $25,000 and $100,000 in insurance respectively.

Experian also offers up to $1 million in ID theft insurance, but only at its highest protection plan. At its lower-priced plan, it offers up to $500,000.

Aura offers up to $1 million in ID theft insurance on all its plans, including the lowest. This covers lost wages, legal fees, and other eligible losses incurred after identity theft and fraud.

| Aura offers up to $1 million in ID theft insurance on all its plans, including the lowest. This covers lost wages, legal fees, and other eligible losses incurred after identity theft and fraud. |

Ease of use

An identity theft protection service is no good if you can’t use it on your device. True, the learning curve of any tool depends on the person using it, but third-party reviews can help you decide if a tool is easy to use or not.

LifeLock works across all devices. You can install it on a Windows or Mac computer, or download the mobile app versions on Android and iOS devices. However, LifeLock has a 1.3 stars out of 5 on TrustPilot, with some reviewers complaining that the tool isn’t user-friendly.

Experian has a 3.7/5 star rating on TrustPilot, with mixed reviews about its ease of use. Some reviewers complained that Experian’s mobile app is difficult to navigate.

| Despite being an all-in-one digital security solution, Aura is easy to set up and use. |

Customer support

When you encounter any problems or receive notifications you don’t quite understand, you should be able to rely on the customer support provided by your identity theft protection service.

If you can’t, then the service is not worth the bucks you’re paying for it.

LifeLock offers 24/7 customer support so you can contact them at any time if you need help. The caveat is that the agents live overseas, so misunderstandings caused by language barriers can occur. But LifeLock’s case managers are all based in the United States.

Experian, on the hand, does not offer 24/7 live customer support. But if you’re a victim of identity theft, you’ll get help from Experian whenever you need it.

Both LifeLock and Experian offer customer support through live chat and email. They also have online documentation to address simpler issues.

| Aura provides 24/7/365 customer support, so you can contact them at any time to resolve issues. If you’re a victim of identity theft or fraud, Aura will connect you to their White Glove Resolution specialists who will work with you to recover your identity and resolve fraud. |

Aura as an Alternative

Founded in 2014, Aura is an all-in-one digital security product that protects you and your family from financial fraud, identity thefts, and online attacks.

Both Security.org and IdentityProtectionReview.com has rated Aura as the #1 identity theft protection tool because of its powerful and proactive features. Aura also has a 4.8 stars out of 5 rating on TrustPilot.

Other identity theft protection solutions offer some of the features Aura offers. But the difference between Aura and these solutions is that Aura doesn’t just respond to online threats, it gets ahead of them.

When you subscribe to Aura, you get a suite of tools, including:

- Identity monitoring

- Financial account monitoring

- Credit monitoring and protection across all three major credit bureaus

- Identity theft insurance ($1 million on all plans)

- Password manager

- Antivirus software

- Virtual private network (VPN)

These tools prevent hackers from getting access to sensitive information, such as your ID number, Social Security number, passwords, online accounts, credit card numbers, and bank account numbers. Aura also surveys the dark web and data brokers to see if your data is exposed there.

If Aura notices any suspicious activity on your credit report or private accounts, it sends fraud alerts to inform you of what’s happening. These alerts are 4X faster than the competition, so you have a better chance of stopping the scammers before they defraud you.

Source: Aura Credit Monitoring

If you subscribe for the family plan, you’ll get alerts if someone is trying to access your children’s private information.

If you become a victim of identity theft or financial fraud, Aura’s White Glove fraud resolution feature will connect you with experts to help you restore your identity and recover your assets. If the damage is too much, Aura offers up to $1 million (increasing to $2 million for couples, and $5 million for a family) identity theft insurance.

Pros of Aura

- User-friendly interface that works on all devices

- 4x faster fraud alerts than competitors, including Lifelock and Experian

- 1 Bureau monthly credit score

- Extensive family plan that protects up to 5 family members (including children) from identity theft

- Transparent pricing with annual discounts

- 14-day free trial and 60-day money back guarantee on annual plans

- 24/7 customer support including White Glove Fraud Resolution

Cons of Aura

- Aura’s starting price points are a bit higher than competitors. But in the long run, it’s cheaper because you don’t have to pay extra money for upgrades and add-ons.

Pricing: 14-day free trial. Paid plans start at $15/month (Individual plan), $29/month (Couple plan), and $50/month (Family plan) billed monthly. You can get a significant discount if you subscribe for the annual plan (e.g. Family plan would cost you $37/mo instead of $50).

LifeLock vs. Experian: you decide

LifeLock, Experian, and Aura offer solid ID theft protection and higher-priced plans give you access to even more features. However, what might work well for one person might not be a great fit for you and your family.

If you’re a tech-savvy person, and you want a hands-off approach to identity and credit monitoring, LifeLock is a great option. With extra security functionalities from Norton, LifeLock can help protect your devices, online data, finances, and identity.

Experian, on the other hand, is best for people who don’t want to spend too much money on identity protection. With its affordable plans, Experian can protect you and your children (up to 10) from identity thieves. And because Experian is a credit bureau itself, you’d have easy access to credit reports, FICO scores, and CreditLock.

However, if you’re looking for an all-in-one digital security solution, Aura the way to go. Not only will you get top-tier identity protection and credit monitoring, you’d also get VPN, antivirus, password manager, and more on all plans, including the lowest-priced one.

Experian doesn’t offer these extra features. Norton 360 does, but you’d have to pay extra bucks for it (in addition to your regular LifeLock plan), which can add up pretty fast.

If you enjoyed this article, you might also enjoy my other two recent articles about cybersecurity: